Technology plays an important role in changing how banks operate and deal with their customers nowadays. A combination of digital progress and financial systems results in smoother, faster, and more protected financial systems. Such events help key players in the field come together and discuss important developments happening there. For example, there is the largest financial technology conference where international financial experts meet to discuss, exchange information, and push the future of banking. Along with highlighting recent changes in digital banking, the banking technology event encourages togetherness among countries, creative ideas, and important business connections for keeping the industry innovative.

- Global Gathering of Financial Visionaries: Every year, people from the banking technology sector come together to talk about the changing factors and difficulties faced in digital banking. Both main banks and tech companies, fintech startups, various regulatory bodies, and schools are among the people attending. At the conference, leaders talk about past mistakes, tell about achievements, and predict upcoming changes in the industry. Many different opinions are shared in discussions since the participants come from all over the world and have different experiences. Merging knowledge and ideas during keynotes, panel sessions, and workshops at such an event helps people from different countries as well.

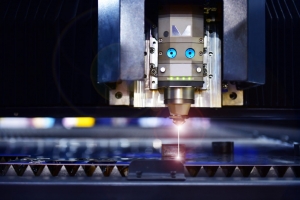

- Exploring the Frontiers of Innovation: The conference's focus on innovation is one of its main characteristics. Rapid developments in blockchain, cloud computing, artificial intelligence, and machine learning have banks always looking for methods to boost customer satisfaction, increase operational effectiveness, and guarantee strong security. Live demonstrations of cutting-edge technology, pilot initiatives, and prototype solutions that might revolutionise financial services are included at the conference. Participants are exposed directly to advancements in robo-advisory platforms, smart contract execution, biometric identification, and real-time data analytics—all of which are changing the banking industry's competitive environment. Because of this exposure, financial institutions can be flexible and adaptable to the changes in technology that are influencing consumer expectations.

- Cybersecurity and Regulatory Compliance: Cybersecurity and regulatory compliance are now the top industry worries as banking becomes more digitalized. These topics receive a lot of attention during the conference, with sessions presented by compliance officials, legal counsel, and security specialists. The changing nature of cyberthreats, fraud protection techniques, and regulatory compliance frameworks in a digital-first world are among the subjects covered. Banks may learn about and get ready for global regulatory changes, including data privacy regulations, open banking requirements, and anti-money laundering standards, at this crucial event. To strengthen their institutions against attacks and create robust, compliant systems that engender consumer trust, participants depart with practical knowledge.

- Digital Transformation Strategies: The road to digital transformation is intricate and multidimensional, including strategy, culture, and technology alignment. In-depth analyses of the different banking organisations' digital transformation journeys are the conference's central focus. The organisational difficulties, technology expenditures, and cultural changes necessary to digitise processes and spur creativity are highlighted in the sessions. Leaders discuss how they are using data to inform decisions, simplifying back-end procedures, and reimagining consumer involvement. The event discusses a clear plan for changing to cloud-based services and makes good use of APIs for engaging with different systems. The approach shows that it is vital for teams to cooperate, move fast, and always come up with new ideas to make a strong impression.

- Financial Inclusion and Customer Centricity: Although technology has a lot of potential, its final worth is determined by how well it works for the user. The conference frequently discusses customer-centric innovation and financial inclusion. Participants investigate how access gaps may be closed by digital technologies, especially in underbanked and unbanked populations. Sessions include low-cost digital payment methods, mobile banking efforts, and support for vernacular languages as means of promoting equitable growth. With talks on multichannel experiences, tailored financial services, and the moral use of consumer data, customer-centric design is highlighted. In addition to being lucrative, the event advances the notion that sustainable financial innovation needs to be accessible, equitable, and empathetically developed.

- The Rise of Fintech Collaboration: There are now more chances for cooperation and co-creation as the boundaries between fintech businesses and traditional financial institutions become hazier. The conference looks at how banks and fintech companies may collaborate to capitalise on each other's advantages—banks' scale and trust, and startups' agility and inventiveness. Partnership structures, investment strategies, and integration frameworks that facilitate productive cooperation are the subject of several presentations. They are suggesting that companies try out new ideas in open-market areas and experimental rules set up by regulators. Cooperating with others, both new and established companies, can set up a good competition and give customers quicker and more meaningful services

- Sustainability and Ethical Innovation: Beyond performance and profitability, sustainability and ethical responsibility are becoming more and more important in the banking industry's future. Discussions like sustainable investment, green finance, and the moral ramifications of algorithmic decision-making are all given a place at the conference. Another main topic is the proper use of AI and consumer data, with sessions looking at how companies strike a balance between innovation and moral limits. Through the incorporation of sustainability into their technological strategy, banks may establish themselves as pioneers in the ethical development of finance.

- Talent, Culture, and Future Skills: Without the individuals behind it, no technical revolution can be considered fully realised. The significance of cultural transformation and talent development in financial organisations is another important focus of the event. Data literacy, cybersecurity knowledge, design thinking, and digital fluency are the talents that will be most important in the banking industry in the future. In a cutthroat digital economy, sessions examine how organisations are luring, keeping, and developing people. Strategies to enable staff members at all levels to contribute to technical growth are highlighted, as is the importance of leadership in creating a creative and inclusive culture.

Apart from presenting the latest innovations, the biggest banking technology conference guides the industry's future moves. With such challenges ahead, events like this give banks the chance to unite their ways of working, technology, and goals as they go forward. At the conference, people discuss new trends, which help boost innovation, shape a company's future, and form a global community focused on financial growth. The event stands for the growth, strength, and ability of banks to adapt to changing desires of clients, new technologies, and stricter regulations all over the world.